We met Jake Hillard and Rebecca Wong 4 years ago when they shared with us an ambitious vision: building a new approach to 3D Vision that makes sensing 100x more powerful.

This is no easy task: companies have spent billions of dollars over the past five years building large teams to push the boundaries of computer vision. "Hardware is hard" as the saying goes. But Jake and Rebecca are both persistent and brilliant. They literally invented mathematical theory and signal processing techniques that previously didn't exist, and spent years perfecting the technology.

This became Red Leader, and the results are revolutionary.

The story of Red Leader has been one of stealthy grit until now. I'll never forget how the specific configuration of cloud formations on a dreary day in Palo Alto was the deciding factor as to whether or not an early Red Leader demo unit worked properly. But with time, the hardware and software were ironed out, top executives from world-class companies joined Red Leader, and the product became ready to market.

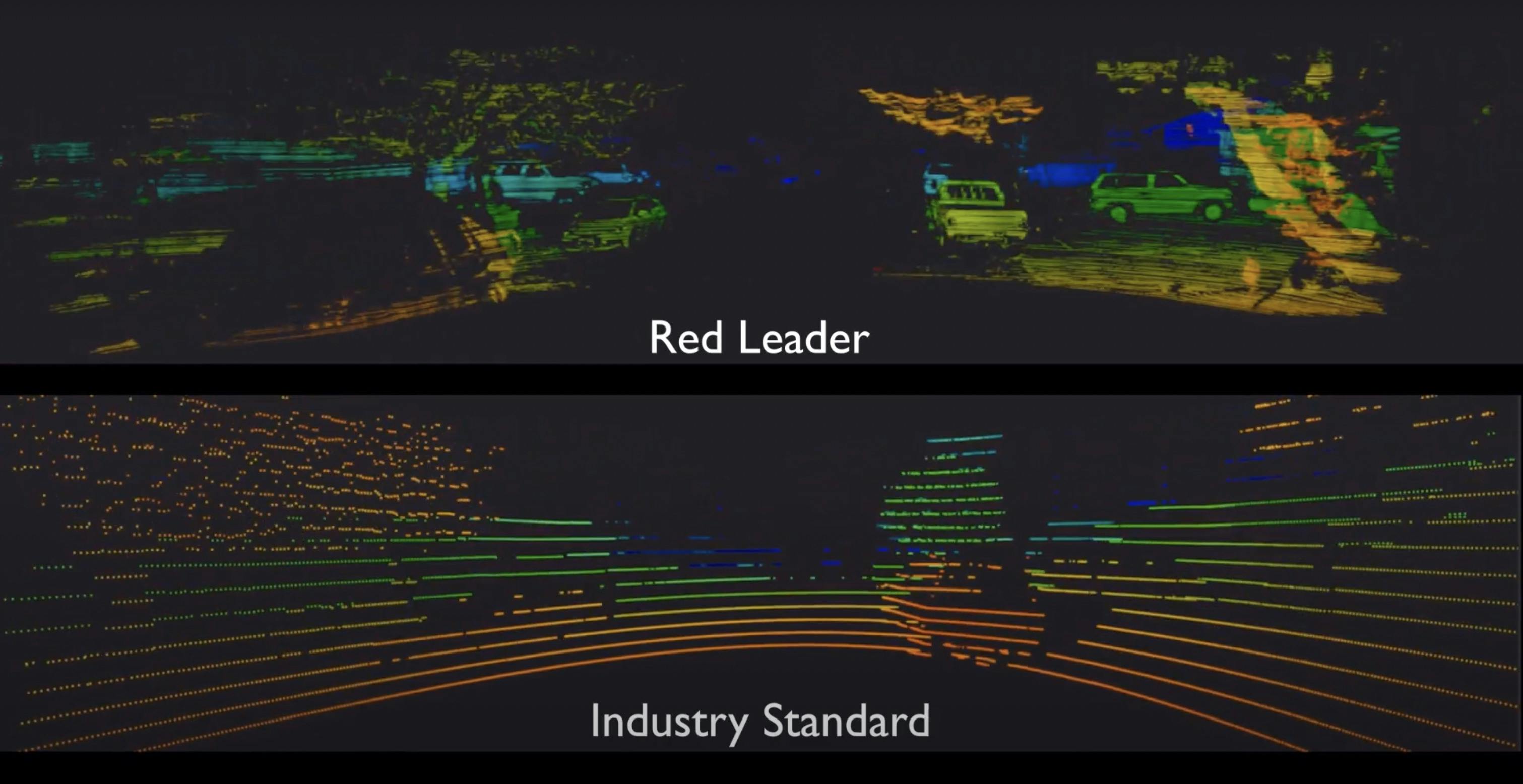

The Red Leader difference can look like the difference between having your eyes open and closed. Look at this example -- one the current industry standard, and one using Red Leader -- moving down a street:

There's nothing else like it in the world. With this degree of 3D perception, problems such as autonomous driving will become far easier and safer.

Jake and Rebecca are wonderful humans, stunningly smart, and their tech speaks for itself. This is why we're so excited to finally announce our pre-seed investment in Red Leader and publicly share that they have raised a $10M Series A.

Disclosure: Nothing presented within this article is intended to constitute legal, business, investment or tax advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Contrary LLC (“Contrary”) nor does such information constitute an offer to provide investment advisory services. Information provided reflects Contrary’s views as of a time, whereby such views are subject to change at any point and Contrary shall not be obligated to provide notice of any change. Companies mentioned in this article may be a representative sample of portfolio companies in which Contrary has invested in which the author believes such companies fit the objective criteria stated in commentary, which do not reflect all investments made by Contrary. No assumptions should be made that investments listed above were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results. A list of investments made by Contrary (excluding investments for which the issuer has not provided permission for Contrary to disclose publicly, Fund of Fund investments and investments in which total invested capital is no more than $50,000) is available at www.contrary.com/investments.

Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Contrary. While taken from sources believed to be reliable, Contrary has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Please see www.contrary.com/legal for additional important information.