A new era of mining is upon us. The global push toward electrification is changing more than just the cars we drive and the way our electric grids are configured. It is re-orienting the global economy around a new set of commodities critical to building the electric storage and essential components that will drive the electric economy.

Those commodities, also known as critical minerals, will be to the twenty-first century what fossil fuels were to the twentieth: a resource that plays a major role in global trade and geopolitics. This is why commentators like Teddy Feldman, a writer who covers contemporary mining, are calling critical minerals the “new oil”.

If minerals are the new oil, then their production will become an increasing economic and geopolitical priority. However, the US is not producing nearly enough of them to meet the lofty electrification goals it has committed to, and has become reliant on foreign countries like China to supply the gap. In 2023, the United States was import-reliant for 95 percent of rare earth minerals, essential for batteries and electric motors.

Although stores of critical minerals are actually abundant in the United States, there are only a handful of operational mines in the US. Meanwhile, proposed mines are finding it nearly impossible to compete on price with the abundant and cheap supply of materials flooding the market from China.

This puts the United States in a kind of Catch-22, which only innovation or firm government action may be able to resolve. However, such efforts will take years to fully implement, which only makes greater attention and directed technological progress toward prospecting, extracting, and processing critical minerals all the more urgent.

The State of American Mining

Mining produces a plethora of valuable inputs from crushed stone and aggregates needed for cement and concrete production to metals like iron, copper, lead, and aluminum used in manufacturing and electronics. However, increasingly some of the most sought-after products are lithium, nickel, cobalt, manganese, and graphite which are fundamental to the design of batteries.

Certain rare earth elements, which are abundant in the Earth’s crust, but rarely found in high-concentration deposits, have unique magnetic properties that have made them essential ingredients in the production of permanent magnets featured in wind turbines and electric motors.

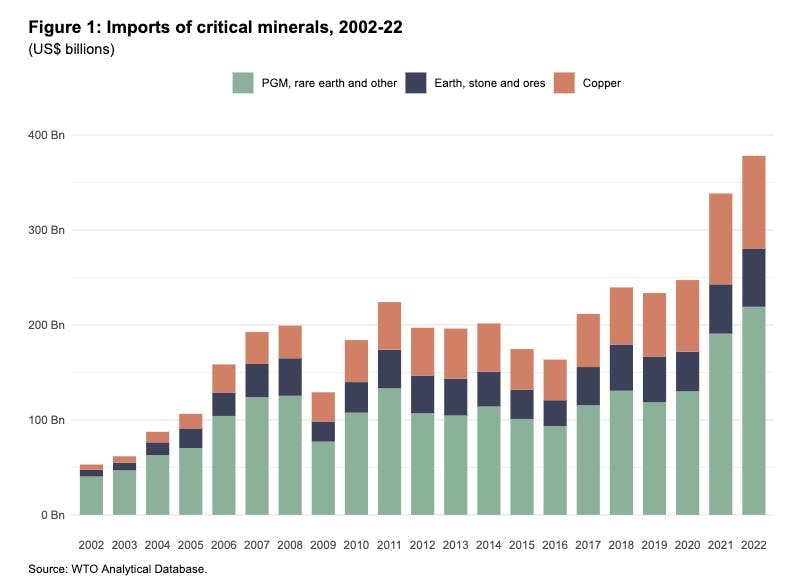

As the adoption of electric vehicles and renewable energy generation has accelerated, the demand for these minerals has exploded. Between 2002 and 2022, demand for energy-related minerals grew seven-fold, from an annual market worth $53 billion in 2002 to $378 billion in 2022.

Source: WTO

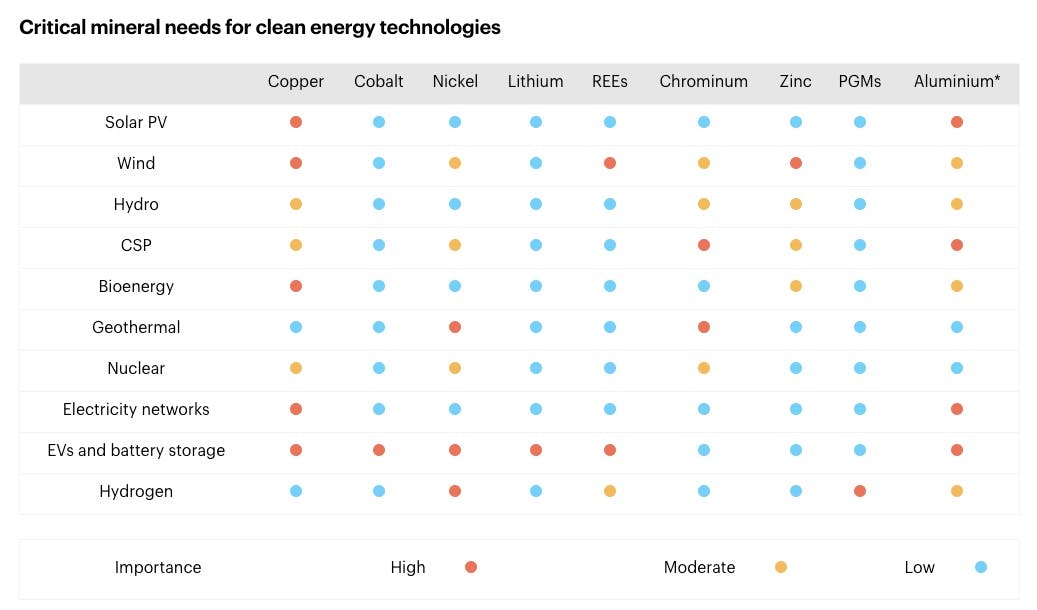

Batteries for energy storage and electric vehicles are already the largest consumers of lithium, and by 2040 the International Energy Association anticipates will take over from stainless steel as the largest customers of nickel. The average electric car uses six times the amount of input minerals that an internal combustion engine vehicle requires, 40 pounds of which are composed of rare-earth elements that feature in the battery, permanent magnet motor, and regenerative braking system of electric vehicles.

Source: IEA

If anything, this trend is likely to accelerate in the years to come. The Biden administration, for example, has outlined ambitious electrification plans for America in the coming years. In 2021, Biden issued an executive order to achieve net-zero carbon emissions by 2050 throughout the economy. This was followed by the administration’s even more aggressive goals calling for a shift to a carbon-free grid by 2035 and for all new vehicles sold by then to be zero-emission.

The only problem is that, as of 2024, the United States only has one active mine producing cobalt, one mine producing nickel, and one producing lithium. Prior to the mid-1990s, the United States actually led the world in lithium production for over 50 years, but a series of environmental regulations imposed during the 1970s along with cost competition from abroad led domestic production to collapse. The gap was filled by imports from foreign mines, few of which adhere to the kinds of environmental and ethical regulations insisted upon domestically.

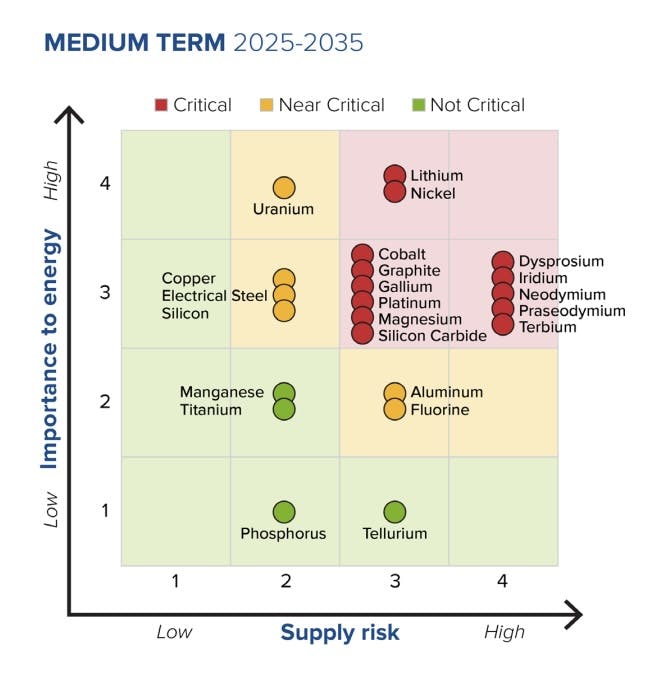

This growing discrepancy between domestic need and domestic production of critical minerals has now been a topic of concern for nearly a decade in the United States. In 2010, the government ordered the creation of a critical minerals list to more closely monitor their supply risk. 50 minerals were identified by the United States Geological Survey (USGS), which reports on their degree of vulnerability annually. In 2023, the USGS found that the United States was 100% import reliant on 12 of these 50 minerals, and more than 50% import reliant on another 29. Notably, China was the leading producer of 24 of the 36 critical minerals with an elevated supply risk, which takes into account the minerals’ importance to energy applications and the diversity of sources from which the mineral can be acquired.

Source: Department of Energy

The problem isn’t that the US doesn’t have enough resources domestically. By all accounts, the United States is swimming in valuable minerals. The issue, apart from regulation and the low cost of foreign competition to American mining efforts, is that we don’t have a good idea of where these minerals are.

To that end, in 2023, the USGS invested millions of dollars to help conduct airborne magnetic and radiometric surveying efforts across New Mexico, Alabama, Montana, and Utah to identify areas that might harbor valuable ore deposits. Recent years have already uncovered veritable motherlodes of critical minerals across America.

In early 2024, a deposit at Halleck Creek in Wyoming was found to contain 2.34 billion metric tons of rare-earth elements, in what is now considered the richest deposit of such elements in the world. In the year prior, Montana was found to contain significant deposits of rare earth minerals too. Meanwhile, in 2023 it was revealed that the Nevada-Oregon border is in fact, home to some 20 to 40 million tons of lithium, the largest known deposit of lithium on Earth.

These discoveries are immensely hopeful, but it’s only here that the real work begins. The International Energy Agency estimates that it takes over 16 years on average for a mine to go from discovery to production, as acquiring permits, designing and building the mine itself, and in some cases the processing facilities are all intermediate steps that take years to complete. Beyond this lies the tricky question of profitability.

On the one hand, it is a positive to have affordable critical minerals as inputs into broader electrification efforts. On the other, persistently low prices make domestic development of these minerals entirely uneconomical. In fact, many American mines that have adequate permits to begin production, like a newly proposed cobalt mine in Lemhi County, Idaho, have stalled simply because global cobalt prices have plummeted. Analysts believe the price action might be a deliberate move on the part of China, which dominates global cobalt production in the Democratic Republic of Congo and has ramped up supply in recent years – a move some think is intended to run competitors out of business. The situation is certainly a Catch-22, but if there’s one way out of this dilemma, it’s through innovation.

Why Mining Is Hard

Finding an Ore Deposit

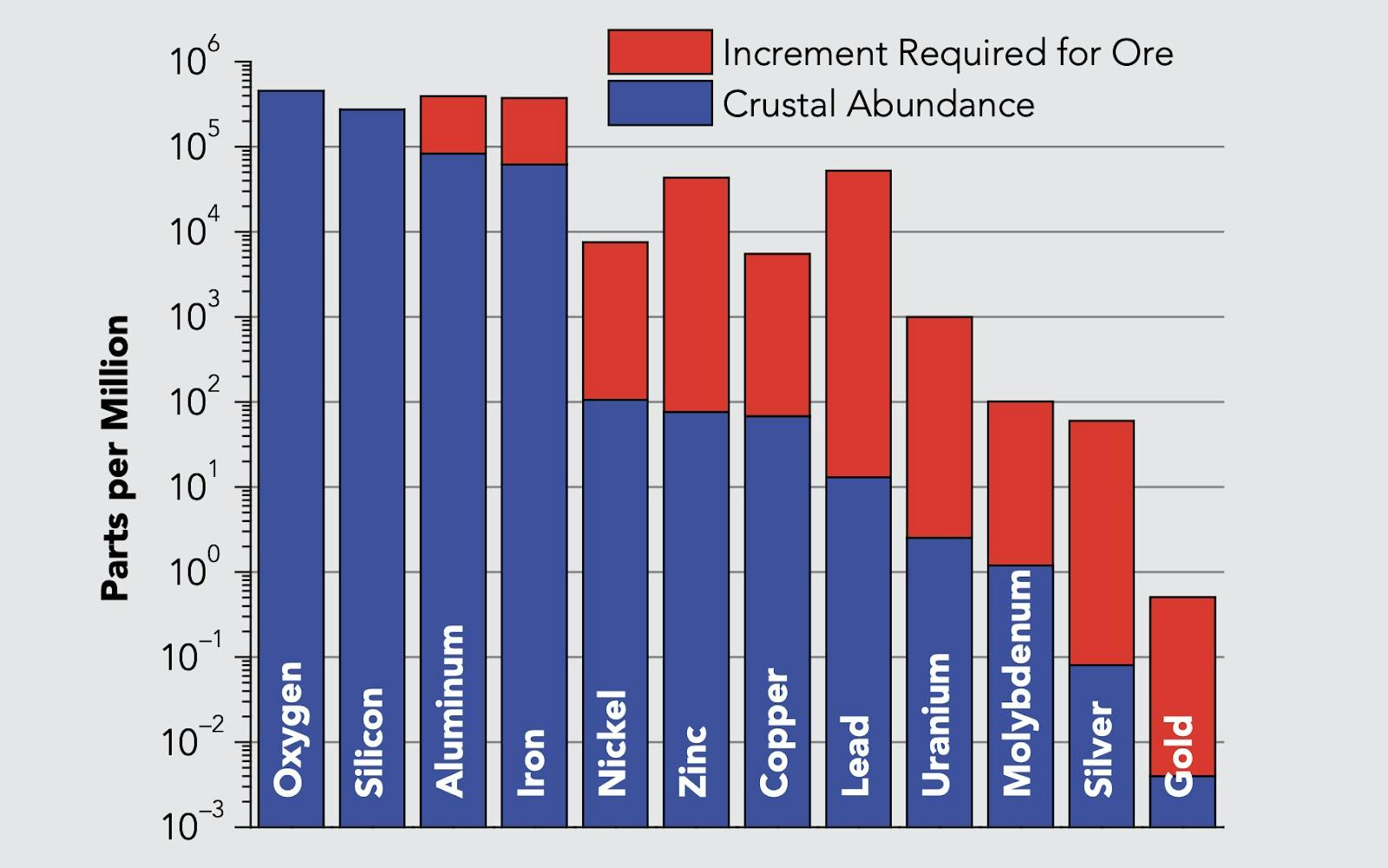

Useful minerals occur everywhere within the Earth’s crust. The problem is they normally occur in very low concentrations. The goal of the prospector is to find ore deposits where the concentration of a particular mineral is abnormally high. The graph below, for instance, demonstrates the typical abundance of various elements in the Earth’s crust in parts per million, and the concentration required for a particular deposit to be considered an ore.

Source: How Mining Works

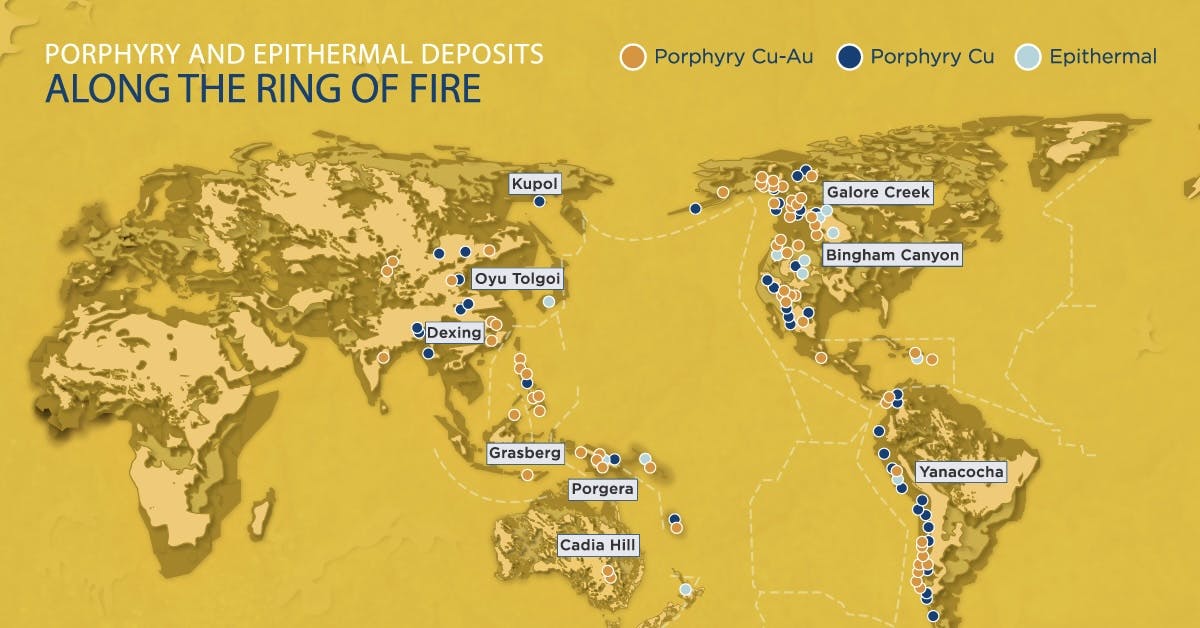

Rich deposits like these are formed by hot magma displacing molten rock and minerals up through layers of rock in continuous cycles that span eons. Over time, the magma cools and forms chambers or veins containing concentrations of economically valuable elements. These types of formations are often associated with regions of volcanic activity, where new waves of hot magma rise to the surface sweeping new concentrations of minerals along with them. Indeed, if you look at a map of volcanic zones overlaid with a map of discovered copper and gold deposits, you will find that the overlap is significant.

Source: Visual Capitalist

Other areas of geological interest, like continental rift zones, where tectonic plates don’t collide, but instead thin out, ultimately break off into separate tectonic plates, can also produce valuable mineral formations and deposits. The Basin and Range Province, underlying Utah and Nevada, is one example of a continental rift zone. It was produced 17 million years ago and now harbors significant quantities of interesting geological deposits.

For an enterprising explorer, these are the most evident and auspicious regions to look. Geophysical surveys, such as those increasingly subsidized by the USGS in the Western states, are some of the first assessments performed to get a sense of what might lie under the earth. Additional measurements analyzing the Earth’s magnetic field or conductivity in certain regions, or airborne radiometric surveys detecting the presence of radioactive particles can help determine the existence of possible deposits.

Once zones of interest are identified, a more thorough campaign must take place to determine the chemical composition of deposits. Ultimately, this involves drilling. Hollow, cylindrical drills with diamond drill bits bore hundreds of meters into the earth to determine the shape and chemical composition of a deposit. Samples are then sent to labs for testing to determine the concentration of valuable elements, which will inform the mining company on what techniques will be required to extract and process the element of interest. Meanwhile, the shape of the deposit will inform the design of the mine required to unearth it.

Building Mines

Ultimately, mines are designed to uncover ore as efficiently as possible, while ideally moving as little earth as possible. Displacing earth is very expensive, so most campaigns will want to do as little of this as possible.

The most effective way of displacing earth and rock is with explosives. Most mines will begin by drilling holes, packing the holes with explosives, and detonating them. Displaced waste rock, also known as “tailings”, which contains no valuable elements, is removed by load-haul-dump trucks. This process is repeated until the ore deposit is reached.

Open-pit mines will do this up until a depth of about one kilometer below the Earth. Their structure, characterized by steep steps that create a conical bowl-type geography, is an economical design that allows mine builders to access the buried ore as fast as possible while also ensuring that any falling material from the lip of the bowl is stopped by the flat catch areas.

Source: Treehugger

The machinery involved in moving the material at mine sites is impressive and expensive. Power shovels, which load haul trucks that carry material out of the pit, weigh over a thousand tons, cost around $15 million, and can lift up to 100 tons of rock. Haul trucks, like the Komatsu 830E can carry over 200 tons of material and cost over $5 million each. The tires of these trucks alone weigh 15,000 kilograms and cost $100,000 each. Operational mines typically have dozens of these on-site.

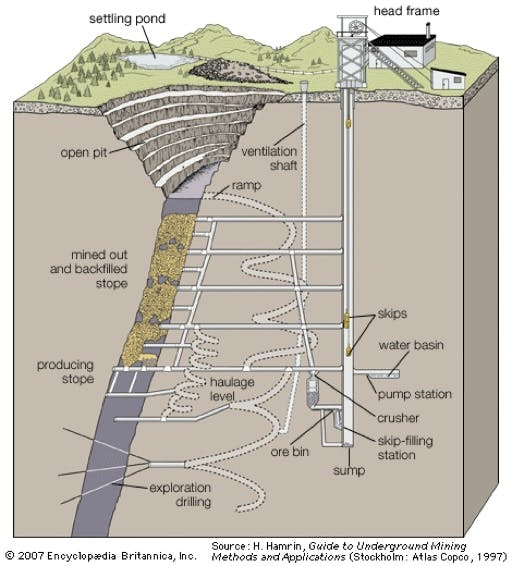

Beyond about a kilometer in depth, however, it becomes more practical to build underground mines. The most elaborate underground mines resemble something like human ant colonies constructed carefully, and at great lengths, to extract ore selectively. All underground mines begin by building a shaft, from which point more complicated underground platforms and structures are built to help access the deposit underground. The exact method of underground mine design used will depend on the shape and orientation of the deposit. For thin and deep deposits, something like a Cut-and-Fill method might be used, where miners extract ore in horizontal slabs starting from the bottom of the deposit, while constructing ramps to excavate ever higher and higher horizontal sections.

Source: Encyclopedia Britannica

Explosives are used to break up the ore in sections, after which the blast fumes must be ventilated and the ore removed by scoop trams and sent up the shaft to the surface. Then, the depleted chambers are structurally reinforced, allowing the surrounding rock to be stabilized while miners move on to other sections. This process is repeated until the entire deposit or the economically recoverable parts of the deposit are extracted.

The technical feats involved in large-scale underground mining operations constitute some of the most extreme engineering done on Earth. Other underground mine designs include Narrow Vein mining, Stoping, Room-and-Pillar, and Block Caving, all of which require a degree of accuracy in planning, blasting, and structural reinforcement performed continuously throughout the lifecycle of the mine are mind-boggling.

While most of the mines operational in the United States are open-pit, the sole functioning nickel mine in the US, Eagle Mine, is an underground mine 3,000 feet deep, which is a few dozen feet deeper than the Burj Khalifa is tall. Ontario, Canada boasts the world’s deepest base metal mine, producing copper and zinc, at a depth of 9889 feet below ground.

The very deepest mines in the world are all located in South Africa, and they’re all gold mines. The deepest in the world is the Mponeng Gold Mine, a whopping 13,123 feet deep. Temperatures increase by roughly 20 degrees Celsius every 3,300 feet down, so at the very bottom of the mine, rock temperatures at Mponeng reach nearly 70 degrees Celsius. The mine is designed to pump slurries of ice to cool the air back down to roughly 30 Celsius.

Concentrating Ore

Once the ore has been collected, it is transported to a concentrator near the mine site, where it is crushed into fine, light particles so the mineral of interest can be concentrated and separated from any waste material.

The exact kind of concentrating process used will depend on the ore extracted and its chemical or physical properties. In general, each concentrating process is built specifically for the type of ore being extracted at the mine site.

For instance, hydraulic washing can be used as a simple technique to separate lighter waste from heavier ore particles. Here, water runs through the ore particles down a grooved slope. The running water washes out the lighter waste material and leaves behind the heavier ore particles.

Other processes include the use of magnetic separators, which run the crushed particles over a magnetic roller that separates magnetic ore particles from non-magnetic waste. Froth flotation is yet another method used to concentrate sulfide ores, meaning metals bound to sulfurs, which occur in igneous formations. The idea here is to separate the sulfide ore from the waste according to the sulfide ore’s hydrophobic and the waste’s hydrophilic properties. The ore is mixed with water and a small amount of oil, which is frothed by an agitator. The froth, coating the ore particles rises and is collected in a separate vessel.

Source: Ecolab

The ultimate goal of these processes is to produce an ore with a high concentration that can be sold to a refinery for further processing. A concentration of 25-30% of the desired mineral is typically sufficient as the final product of this stage. For most mines in America, this is the product that is ultimately sold as primary inputs to refineries or other plants that process this mineral concentrate into more purified or final goods. The vast majority of such processing plants, however, are not in America but abroad. Most of the ore mined or collected in America, is shipped to China for smelting and conversion into steel.

Mining Needs More Technology

Every single step in the development of a mine, from initial prospecting to the design and construction of a mine, to the creation of bespoke concentrator facilities takes years and hundreds of millions of dollars. It’s an industry that is ripe for process improvements that can shrink timelines, costs, and energy expended in getting crucial minerals out of the ground.

One of the first places to start is innovations in prospecting. For decades now, the mining industry’s rate of successful exploration has been falling dramatically. Today, it stands at 0.5%, meaning that only 0.5% of all mining campaigns yield a discovery worth the investment.

The reality is that it’s extremely difficult to predict what’s going on underground, even with aerial radiometric surveys or planes that fly overhead tugging a transmitter coil loop, essentially an airborne metal detector, to assess the level of conductivity below ground.

Source: KoBold Metals via IEEE Spectrum

Historically, exploration has involved extreme levels of uncertainty, extensive and expensive trial and error, and in the best outcomes, luck. As a result, most mining companies would rather spend money purchasing deposits that have already been identified than go out looking for new ones.

The lack of exploration to find new, better deposits, hidden deeper underground, has meant that the quality of ores being mined has declined over time. This means companies have been spending the same expenses to extract fewer and fewer metals

To combat this, companies like KoBold Metals and Earth AI have emerged to let artificial intelligence help make inferences about where these valuable deposits lie. As the founders of KoBold Metals wrote, “There is a vast body of geoscience information already in the public domain, but it’s dispersed and fragmented.”

All this data may contain clues as to the location of yet undiscovered mineral deposits, but no one knows how to make sense of it. KoBold has trained a proprietary model called TerraShed on this public body of geological, geophysical, and geochemical data to direct explorers toward auspicious mining regions. From there, further testing is required to learn more about the particulars of the region. All the new data acquired is fed into the model which continuously updates to provide more and more accurate directions as to where fruitful deposits might lie.

EarthAI, profiled in Not Boring by Packy McCormick, uses their AI model, which helps predict the location of hydrothermal systems, as a compass to go out and do the exploration work themselves. If traditional mining companies don't want to go and find new deposits, they will. EarthAI has made four attempts to discover new deposits, three of which have been successful. It’s a success rate unheard of in traditional exploration and mining.

Outside of prospecting and exploration, other processes involved in extracting and concentrating minerals could have a massive impact on increasing the speed and efficiency of mining processes. A great example of this occurs in lithium mining. The sole lithium mine in the United States isn’t even really a mine, as the lithium isn’t deposited in rock, but in a salty, underwater brine. To extract lithium, the brine is collected in massive pools above ground where it sits for months, waiting for the sun to evaporate all the water, leaving behind just the salt and lithium.

Source: CNBC

Instead of all this, a more common sense approach would be to use direct lithium extraction, a technology that pumps lithium-containing brine, immediately eliminates the lithium via an absorbent resin, and immediately re-injects the brine back underground. It’s a solution that requires over 20 times less land than the pooling method, costs almost as much, and extracts 30-50% more lithium.

This technology has already been implemented in China. Tesla, which has acquired mineral rights to lithium-rich clay deposits in Nevada, anticipates using a similar technology to extract lithium at its new site. Given that lithium is contained within clay, it will be first mixed with water before being run through the direct extractor, whereupon the clay will be returned back to where it came from.

New approaches to mining are also making headway. Magrathea Metals, for example, has developed technology that can separate magnesium from seawater just as a direct lithium extractor can remove lithium out of brine. The company has already produced ingots of magnesium from the sea!

The World Bank estimates that to complete a global transition to electric vehicles, we will need to discover another $15 trillion worth of copper, cobalt, lithium, and nickel by 2050. Currently production capacity is only capable of producing about a fifth of that. This means that to fill the gap, up to 300 new mines will be needed by 2030.

An undertaking of this scale will crown critical minerals as the most important commodity in the world, displacing oil. However, doing so quickly and in a way that will ensure a reliable domestic supply, can only be achieved through greater technological innovation. A number of clever startups are already on board, working to bring mining into the 21st century. It’s time for the rest of the industry and regulators to follow their lead.

Disclosure: Nothing presented within this article is intended to constitute legal, business, investment or tax advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Contrary LLC (“Contrary”) nor does such information constitute an offer to provide investment advisory services. Information provided reflects Contrary’s views as of a time, whereby such views are subject to change at any point and Contrary shall not be obligated to provide notice of any change. Companies mentioned in this article may be a representative sample of portfolio companies in which Contrary has invested in which the author believes such companies fit the objective criteria stated in commentary, which do not reflect all investments made by Contrary. No assumptions should be made that investments listed above were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results. A list of investments made by funds managed by Contrary (excluding investments for which the issuer has not provided permission for Contrary to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at www.contrary.com/investments.

Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Contrary. While taken from sources believed to be reliable, Contrary has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Please see www.contrary.com/legal for additional important information.